Granthera announces the launch of a strategic investment product — the Crypto Loan, introduced ahead of major transformations in the Russian financial system and the integration of the digital ruble, which will become an official settlement instrument starting September 1, 2026.

• Funding the "Crucial Phase": Investor funds will serve as operational capital for developing and testing technological gateways, refining lending scenarios, and implementing preventive compliance measures. By September 2026, the platform will be fully operational.

• "Pilot Client" Status and Simplified Onboarding: Investor accounts are pre-structured and reserved within the CBDC platform. On launch day, accounts are automatically activated, providing priority access.

• Yield Strategy: From Current Profit to Secured Liquidity: Investors secure a strategically important position within the future financial ecosystem.

• High Return Rate (Current High-Margin Period): Returns are generated through wholesale crypto lending. Funds create a robust liquidity pool and a safety cushion for future digital ruble operations.

• Reliability Based on Regulatory Compliance: Infrastructure is built in full compliance with regulatory requirements, ensuring the highest level of legal and technological protection.

The launch of the Crypto Loan underscores Granthera’s strategic position: the company is actively shaping a new financial era, securing a key role for itself and its investors in the future hybrid system.

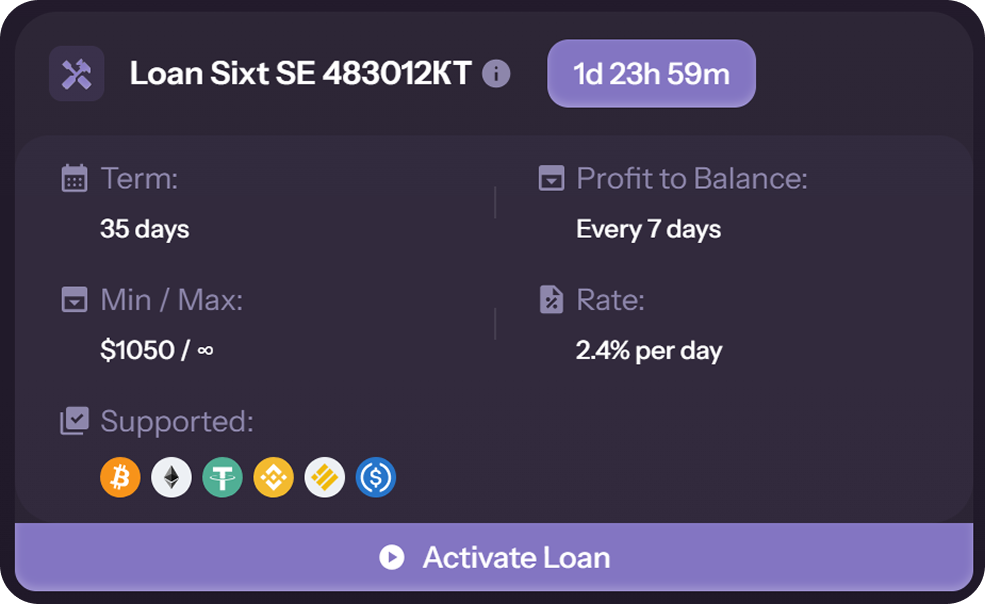

Detailed terms of the crypto loan program are available in your account under the "SE Loans" section.